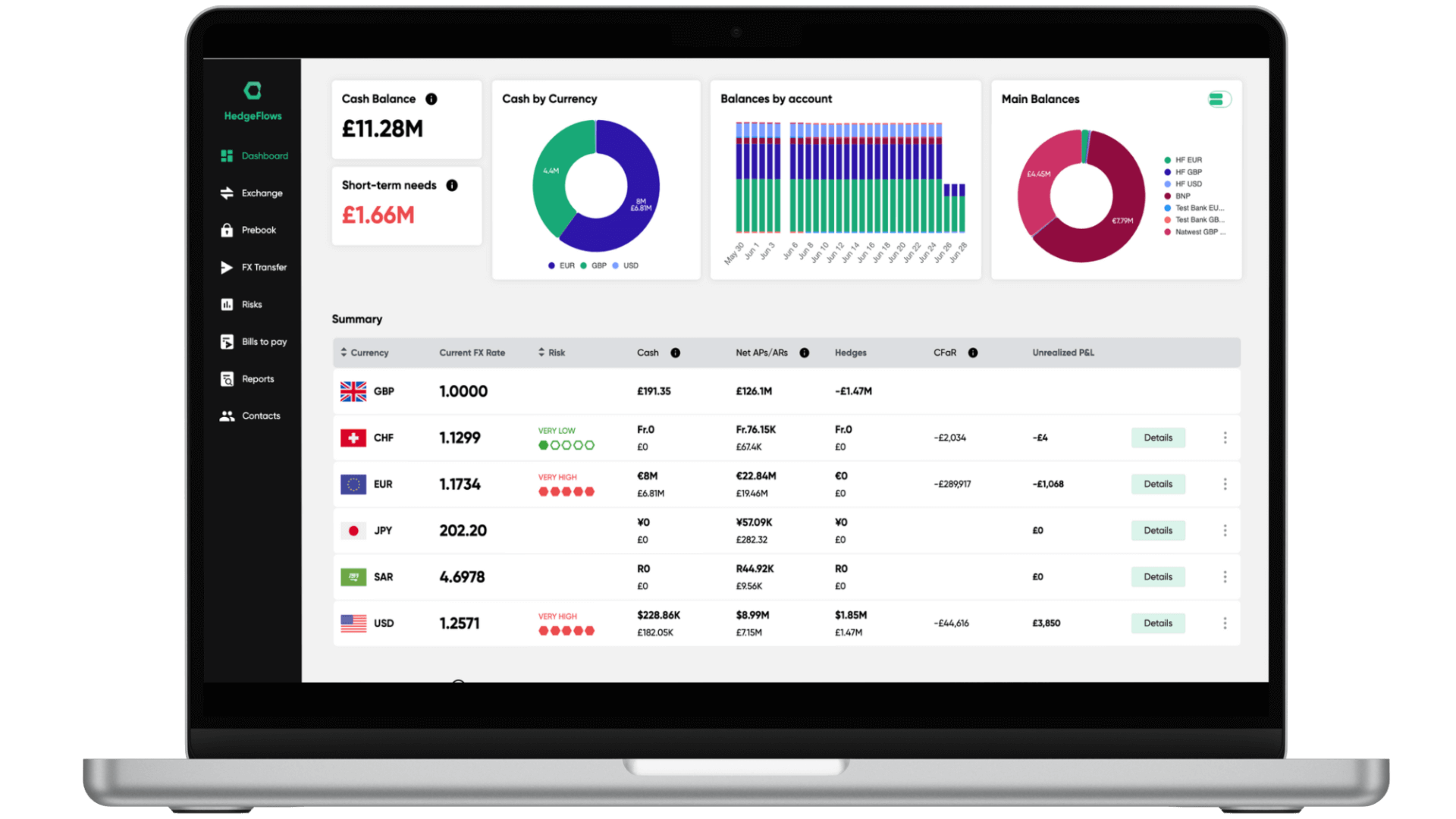

Manage cash, payments and financial risks in one place

Modular treasury, risk management and automation platform for startup CFOs that need scalable financial processes to help them plan and grow globally

Trusted by:

.png?width=500&height=250&name=FS%20Mackenzie%20International%20Group%20(1).png)

Save both time and money as you grow beyond borders

Pay and get paid like a local in USD, GBP, EUR and 30+ other currencies with your own IBAN and local bank details around the globe. Save time with our unique bookkeeping automation that removes the complexity of dealing in multiple currencies.

Local account details to get paid in GBP, USD and EUR

Get paid by your clients directly into your HedgeFlows account via Faster Payments (UK), SEPA (Europe) and ACH (USA).

Global bank transfers & collections in 30+ currencies

Bank transfers to and from 150+ countries in 30+ currencies via local payment schemes and and international SWIFT network.

Easy payment runs with Xero, NetSuite, Dynamics

Save hours on domestic and international payments with our market-leading payments automation that syncs with your accounting and ERP system in real time.

from

Includes a FREE monthly allowance for payments in GBP, USD and EUR.

HIGHLY COMPETITIVE

Better than WISE or Airwallex - you will save more on international transfers

up to

With our AP automation and cash management solutions

Plan and manage cash across multiple entities and currencies

Streamline cashflow forecasting and liquidity management thanks to robust real-time integrations with multiple ledgers and ERP systems.

Consolidate in real-time across systems and accounts

Integrate HedgeFlows with your accounting or ERP systems with our easy, no-code connections. Get real-time bank account information and transactions directly from your banks and other providers and HedgeFlows gives full picture of your current and future liquidity situation.

Plan cashflows in multiple currencies & geographies

Easily plan and manage cashflow forecasts across currencies and geographies. Connect feeds from your favouring FP&A tools and spreadsheets.

Access deposits and lending offers in real-time

Regain full visibility of your cash and currency needs with our dashboards and planning tools and access lending and deposit needs you qualify for.

Protect your margins from currency costs and risks

Gain full visibility about your upcoming currency needs and manage your currency costs and risks like a pro with our award-winning platform.

Protect funds in foreign currencies from FX risks

Prebook guaranteed exchange rates to remove FX risks that could affect your financial results and runway.

Implement robust treasury and risk management policies.

Access our award-winning risk management platform for mid-market businesses

Access support from industry-leading experts

Learn about liquidity and risk management with our online training videos, guides and one-to-one coaching.

What do our clients say:

-

HF provides a great solution to FX payments around the world and creates time and cost efficiencies throughout the end-to-end payment and reconciliation process.

Jason

Finance Manager, Niarra Travel -

HedgeFlows is more methodical about our hedging process - before they helped us, our process was just kind of opportunist.

Nick

Finance Director, Pact Coffee -

HedgeFlows is a real game changer for us. It's saved us loads of TIME and EFFORT, completely revolutionizing how we handle payments. Its user-friendly interface is loaded with features, making it easy to navigate and highly flexible.

Mohammad

FD, Vogacloset -

Super access to treasury for smaller companies. Better exchange rates than our bank, excellent client-focused service, and plenty of data to make better currency decisions. The perfect option for a smaller business.

Stephanie

FD, BeloFX

Integrate with your system to streamline your processes

HedgeFlows works by connecting to your existing data from accounting, ERP or Transport Management Systems to give you full visibility, process automation and access to financial services via modern and secure API connections.

1. Connect your system

2. Setup roles and processes

3. Access financial solutions

-1.png)

Frequently asked questions:

How long does it take to go live on HedgeFlows?

You can go live with HedgeFlows in a day - integrating with popular accounting and ERP systems takes a few minutes, and you can register your business by completing our online

How safe are my funds and data?

HedgeFlows is an FCA-regulated business and meets strict data privacy and client money regulatory requirements. Similar to your bank, access to your HedgeFlows account and any data is restricted to authorised users and protected with Multi-factor Authentication. Your funds are segregated from HedgeFlows' own operational funds as well as other clients' money.

How do you differ from my bank, FX broker, or payment provider?

HedgeFlows offers award-winning integrations with your systems to help you eliminate manual tasks, streamline your workflows and reduce financial and operational risks. We also give you more access to financial services: from payments to transactional FX, trade finance and lending.

How robust are your solutions?

Very robust. HedgeFlows is built by industry experts who have run global businesses and technology teams for the world's largest banks for the past twenty years. We partner with leading software and financial service providers to deliver innovative solutions without any compromises on security and reliability.