Reduce effort & cut costs on Global Business Payments

Domestic and global payment automation, FX risk and cash management for modern finance teams.

HedgeFlows vs XE.com: Compare the cost of ownership side by side

XE.com |

HedgeFlows |

|

|

Starting subscription package |

free |

from £ 99 |

|

Monthly allowances |

N/A |

100 Local payments |

|

Domestic & Local Transfer fees |

£ 1 - 1.50 | Free within allowance |

|

Foreign Exchange Fees |

0.50% - 2.00% | 0.25% - 0.50% |

WHAT DO OUR CLIENTS SAY:

-

HF provides a great solution to FX payments around the world and creates time and cost efficiencies throughout the end-to-end payment and reconciliation process.

Jason

Finance Manager, Niarra Travel -

HedgeFlows is a real game changer for us. It's saved us loads of TIME and EFFORT, completely revolutionizing how we handle payments. Its user-friendly interface is loaded with features, making it easy to navigate and highly flexible.

Mohammad

Head of Finance, Vogacloset -

After starting to use Hedgeflows recently, we have not only saved a huge amount TIME and EFFORT but also created a super slick process that has literally changed the way we do international payment runs forever!

Chris

MD, FirstPoint Logistics -

HedgeFlows has made our weekly payment runs far QUICKER and EASIER, and is a great workaround to Xero's restrictions on only creating payment runs for GBP.

Chris

Accountant, Signify Technologies -

It has made making non-GBP payments simpler and cheaper to do!

It also helps recognise where we are exposed as a business to FX rates.Ben

Finance Director, Champo -

We have been using Hedgeflows for almost 10 months now. Brilliant FX service with the sync with XERO works very well.

Sean

Accounts Team, TransferRoom

How does HedgeFlows compare to XE.com?

XE.COM |

HedgeFlows |

|

|

Authorised & regulated by the FCA |

✅ |

✅ |

|

Cross-border payments |

✅ |

✅ |

|

Domestic payments |

❌ |

✅ |

|

AP Automation |

❌ |

✅ |

|

Cross-border collections |

✅ |

✅ |

|

FX Forwards |

✅ |

✅ |

|

Transparent FX markups |

❌ |

✅ |

|

Accounting / ERP integrations |

Microsoft Dynamics & Sage only | Xero, Quickbooks, Netsuite, MS Dynamics |

|

Global payment coverage |

190+ countries | 180+ countries |

| AI-powered capabilities | ❌ | OCR, Fraud & Error detection |

| Additional features & modules |

Currency Rates API feeds |

FX Hedging Copilot, Open Banking, Cash Management, Cashflow planning |

More than international payments app

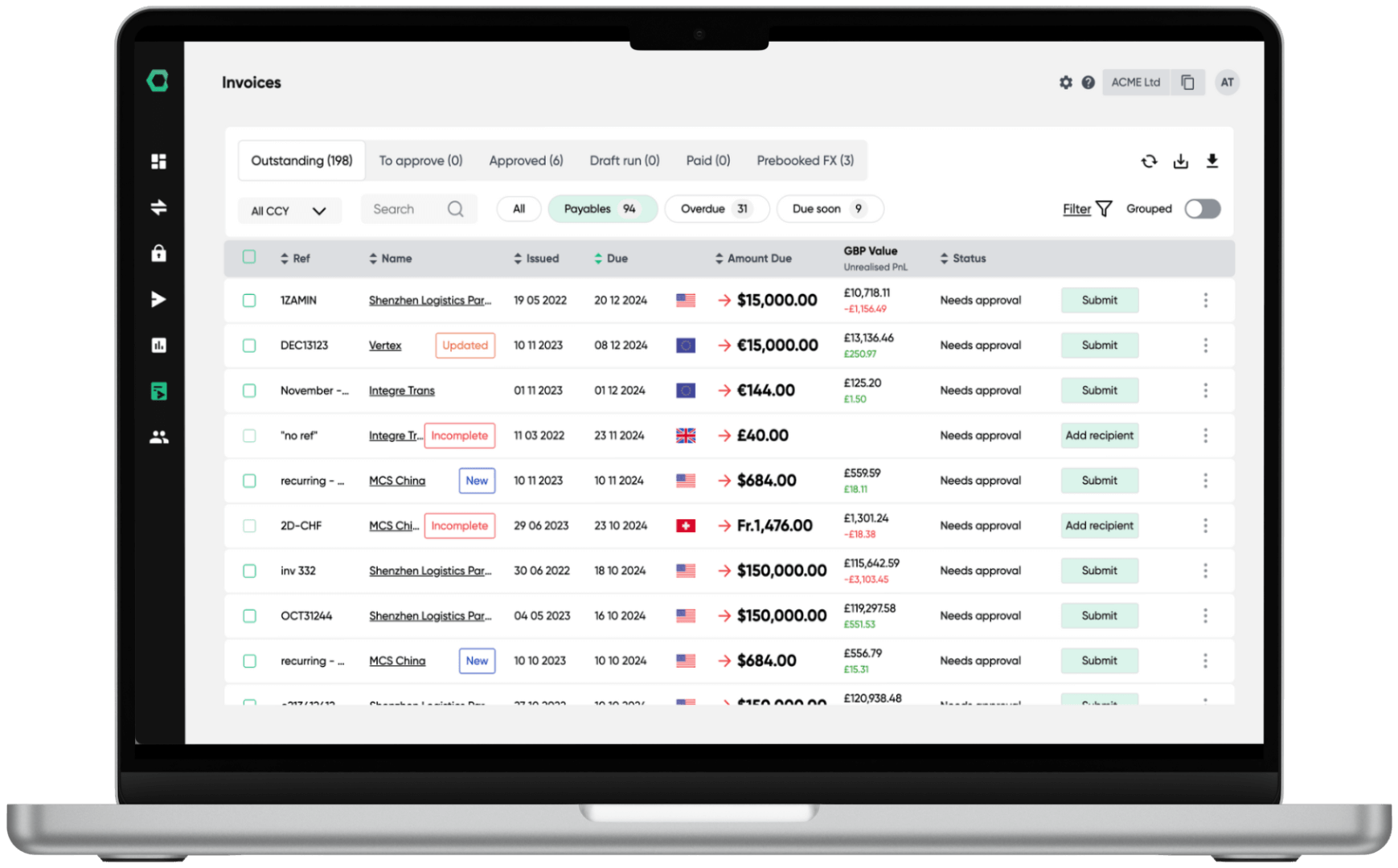

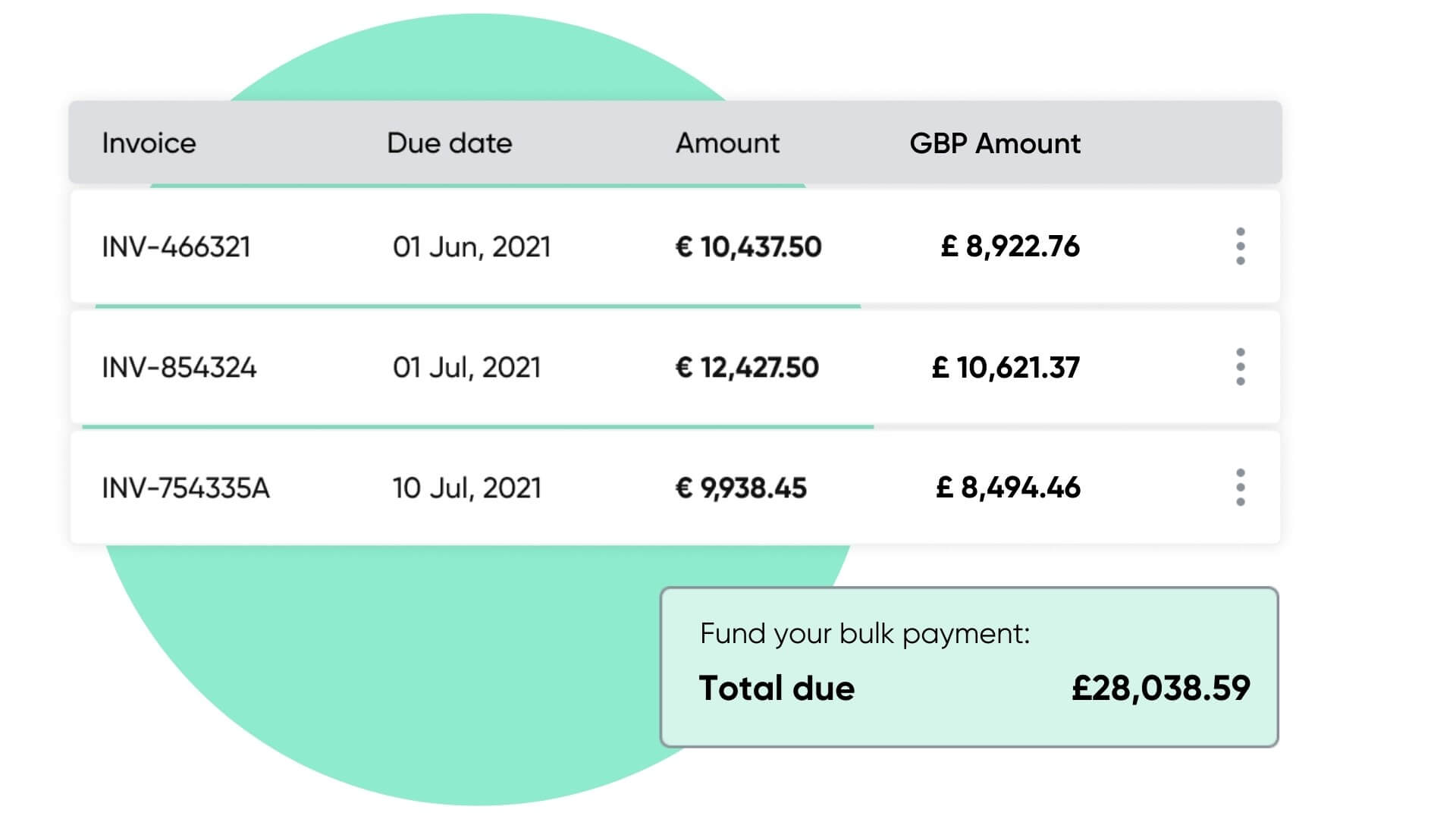

HedgeFlows streamlines global vendor and payroll payments by embedding with popular ERP and accounting systems. Select the invoices you want to pay, purchase FX if needed, and send funds to your HedgeFlows account. We automatically handle the mundane bits such as remittance emails and reconciliations.

Join the movement - transform your global finances into a modern digital process and reduce effort and costs.

No More time-sapping BANK TEMPLATES.

No More clunky BACS FILES.

No more waiting for BANK FEEDs.

EXPERIENCE OUR TIME-SAVING PAYMENT RUNS IN 90 SECONDS

Revolutionise your payment process in any currency by connecting your system in minutes:

CASE STUDY

SUPPORTING FAST GROWTH WITH SUPPLIERS & STAFF WORLDWIDE

Moteefe is a rapidly growing e-commerce platform that specializes in selling customised merchandise through social media channels. As an international business, they face the challenge of making payments to suppliers and employees across the globe. Prior to adopting HedgeFlows, their payment processes were manual, error-prone, and time-consuming, involving multiple banks and complex reconciliations.

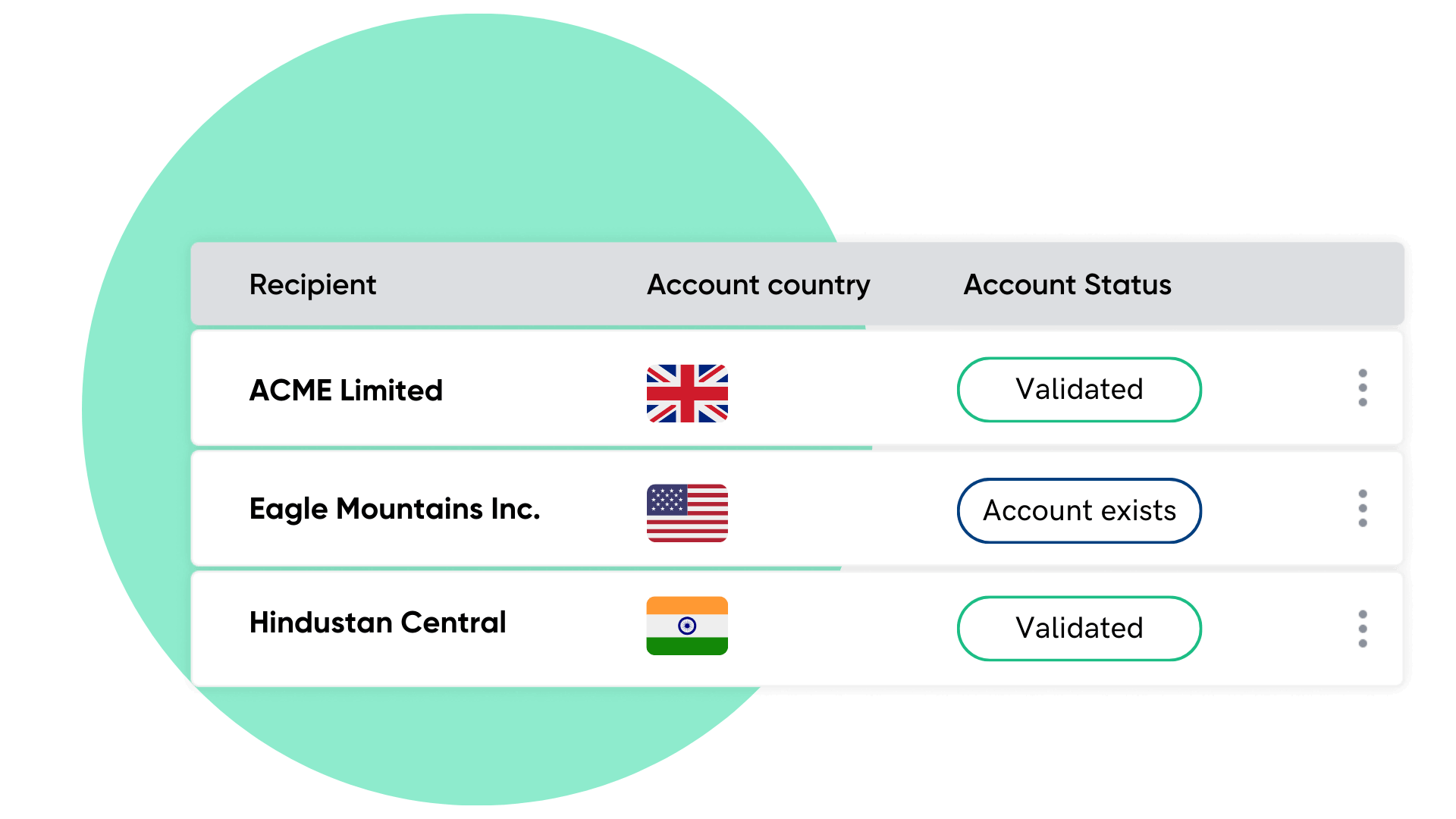

Technology to prevent fraud and errors

Authorised Push Payment (APP) fraud is a growing problem. Every year, thousands of finance teams are tricked into sending money to criminals using fake or stolen identities. Our global bank account validation helps prevent payment fraud and manual errors.

Confirmation OF PAYEE

BANK ACCOUNT VALIDATION

FRAUD MONITORING & ALERTS

CASE STUDY

How ALICE saves hours EACH WEEK AS HER BUSINESS GROWS

"Being able to pull the invoices and pay them directly with HedgeFlows is great. It's not a challenge anymore. Feeding invoices back — I didn't know that was even a challenge, and now you guys do it for me!"

Hear more from Alice on how her team saves hours each week as they process 100s of invoices in multiple currencies:

From

Subscription includes 100 free local payments in GBP, USD and EUR.

HIGHLY COMPETITIVE

Pay just 0.25% markup above the interbank exchange rate. Without any surprises.

up to

Our clients save up to 80% of their time spent on payment runs when they use HedgeFlows.

Transform how you manage vendor payments today:

1

SIGN UP TO HEDGEFLOWS

Sign up for free using your email address at app.hedgeflows.com/sign-up.

2

Connect your accounting system

Sync HedgeFlows with your ERP or accounting system in a few easy clicks.

3

REGISTER YOUR BUSINESS

Register your business to start saving time and managing finances with HedgeFlows.

Got a question? Here are some popular ones:

What invoices can I pay via Hedgeflows?

HedgeFlows makes paying domestic or international invoices from systems such as Xero, NetSuite or Microsoft Dynamics Business Central easy and faultless. Once vendor invoices are authorised in your system, they appear in HedgeFlows, and you can simply choose the list of invoices you wish to pay. You can fund your payment run from your trusted bank account, and we automatically process any optional currency conversions, make correct transfers, send remittance emails and reconcile back to General Ledger for you!

Do you have an approval process for payments?

Yes, HedgeFlows offers a customisable approval process with individual roles and limits to support your payment run needs.

How safe are payments and funds handled by HedgeFlows?

Independently regulated

Unlike many other payment automation software vendors, HedgeFlows is independently regulated by the FCA as a payment institution (FRN 1008699). This means that we adhere to the highest standards in safeguarding clients’ funds, aligning with the stringent protocols by which all banks and top fintech firms in the UK are regulated.

Named accounts and Safeguarded funds

When HedgeFlows handles client funds to process payments, we segregate them from our operational accounts and always keep them in clients’ named payment accounts. When funds are kept with HedgeFlows for more than one business day, they are safeguarded with authorised credit institutions (banks), meaning they are held separately and can only be used for payments as instructed by our clients.

Automated Sweeps to your Bank

HedgeFlows automates periodic sweeps of unused funds back to bank accounts. This means you can further reduce the risks of erroneous or fraudulent transactions by sweeping any unused balances back to your bank at the frequency of your choice - daily, weekly, or monthly.

Why is it safe to connect my ERP/account to HedgeFlows?

Unlike many other payment automation software vendors, HedgeFlows is independently regulated by the FCA as a payment institution (FRN 1008699). This means that we adhere to the highest standards in safeguarding clients' data and security policies, aligning with the stringent protocols by which all banks and top fintech firms in the UK are regulated.

Your client access is secure using the latest Strong Customer Authentication technologies, and our advanced role-based access controls help you easily assign team members the necessary access rights.

I have an external accountant, can they use HedgeFlows?

Of course, we are working with the leading accountancy practices in the UK already and are helping make foreign currencies simpler for thousands of small businesses in the country. You keep control of the validation of foreign payments, while your accountant takes care of processing the invoices, cash management, and accounting tasks.

Are payment runs made straight from my bank account?

HedgeFlows offers a range of solutions to process your payments. If your bank supports Open Banking services, you can rely on our robust payment initiation technology to make vendor payments straight from your bank by preparing your payment runs in HedgeFlows and securely authorising via Open Banking.

Otherwise, you can also rely on our industry-leading payment infrastructure to process payments via your multi-currency payment accounts with HedgeFlows and simply fund them with a single transfer from your bank.